BP tries to shirk responsibility in Gulf oil spill case

I’d have to agree with a recent headline at MarketWatch: Sweet Deal for BP. Too sweet in fact. That BP is getting off the hook with only about $8 billion in fines from its major criminal charges is disappointing to say the least, as it just goes to show that with enough money, any disaster can be bought off and erased. And the real kicker is the revelation that former BP CEO Tony Hayward, under whose watch the Deepwater Horizon disaster occurred, was given shares worth about $1.11 million as a bonus last month by BP–apparently for his stellar job as CEO? This is doubly ironic given the fact that, as the WSJ reported, Hayward’s bonus “comes a year after BP decided not to pay bonuses for 2010 to any of its directors who had responsibility for operations in the Gulf of Mexico.” Remember, at BP all CEO’s are exempt from responsibility for anything, a lesson Tony Hayward reminded us when he went speedboat race watching at the height of the BP disaster.

The only public parties now left are the US government and gulf states, the other major parties in the case against BP are the three companies involved in the Deepwater rig operations (Transocean, Halliburton and Cameron). Unless the US gov’t holds their ground and makes this into a major political and legal event, which I’m not going to hold my breath about, it seems that BP will have learned nothing other than how to clean up a mess without cleaning up a mess.

The BP oil spill case was slated begin on March 5th, but BP reached a last-minute agreement with the other parties to the case. But as the Guardian correctly reports, even though an $8 billion settlement is nothing to sneeze at, this is only the tip of the iceberg. As MarketWatch reported:

“In addition to the $7.8 billion, BP said it’s already spent more than $22 billion in the Gulf, including $14 billion on its operational response and $8.1 billion to individuals, businesses and government entities.”

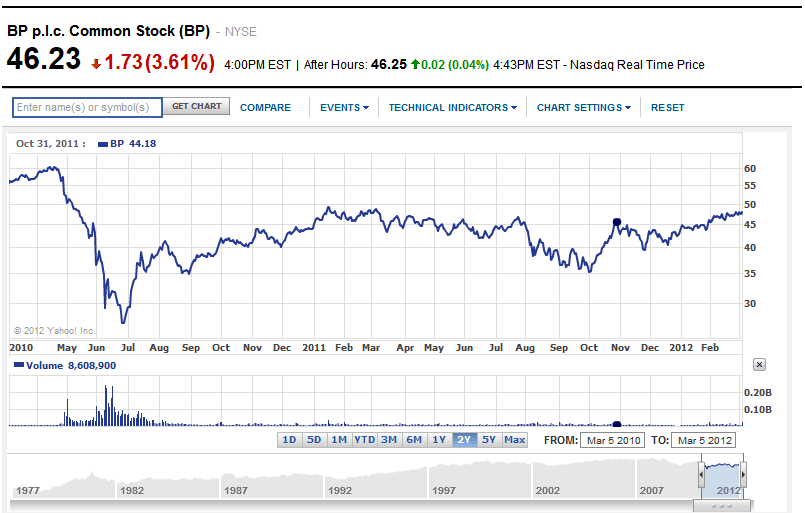

So BP spent somewhere around $30 billion dealing with the fallout of the spill, and still the impacts remain, and will for years and years to come. Meanwhile, it was back to business as usual for BP, as a CNN headline from July of 2011 proclaimed whopping second quarter profits for the industry giant:

“Oil giant BP is back in the black, announcing profits of $5.3 billion just a year after the Deepwater Horizon disaster left it facing heavy losses.”

And as a Yahoo Finance article from last week importantly noted, BP made a shrewd move by settling out of court, even at the cost of nearly $8 billion. Why? Because BP could have faced an upwards of $50 billion in fines from the judge. So instead of having to pay $25-40 billion in environmental fines for the biggest environmental disaster in US history, it just bought out all of the plaintiffs for a mere $8 billion, an amount it almost made back in full from profits in just one quarter last year.

“BP has to weigh its chances of getting off cheaper by piecing together a sweeping settlement or put its fate in the hands of one man, a federal judge who will hear testimony in lieu of a jury. If the judge sides with plaintiffs on the amount of oil spilled and determines BP was grossly negligent, the company conceivably could face up to $52 billion in environmental fines and compensation alone, according to an AP analysis.”

So once again, the American people, and the Gulf Coast wildlife, suffer while BP makes a tidy profit. After all, how else could we explain a company unleashing the worst environmental disaster in the nation’s history and then turn around to continue making record profits?

Until next time…Remember, Crime Pays.

###